720 Investor is the brainchild of Ed Butowsky and Joseph Harberg. Ed serves as Managing Partner of Chapwood Capital Investment Management, where he focuses on business development and providing clients with comprehensive array of investment management services. He served as President and Chief Executive Officer of Chapwood CustomHedge Portfolio Advisory Services, LLC. He appears frequently on Fox News’ “Fox & Friends” and on CNBC. Joseph is a founder and managing President of Retail & Restaurant Growth Capital, an investment fund focused on growing retail and restaurant ventures. RRGC/Harberg have participated in transactions totaling over $1B of invested capital into early stage retail and restaurant companies since 1995. Some of Joe’s early finds and investments include Restoration Hardware, Quizno’s, Elizabeth Arden Red Door Salons, Cafe Express, the Walking Company and Uncle Julio’s.

Video Joseph Harberg / 720

Ed Butowsky promoted several companies including CORE RESOURCE MANAGEMENT, INC. including a video (720 investor) on youtube.

Chapwood’s Butowsky Joins Core Resource Board

You Tube Video has been removed

Brown Glenn Legal Activity

Form 10-K Core Resource Management For: Dec 31,2014

On or about August 21, 2013, W. Brown Glenn, Jr., the Chief Executive Officer and a director of the Company wired $460,000 of the Company’s funds to a law firm in Minnesota to settle a judgement which had been entered against Pegasus in a matter completely unrelated to the Company. In his instructions to the Company’s bank, Mr. Brown indicated the wire was for a transaction with Nacona Production Company and caused the Company to file its Form 10-K reflecting that the wire was a deposit against a pending asset acquisition, all of which was not true. The Company has been aggressively pursuing its claims against Pegasus and its members including, Mr. Brown. The Company has settled its claims against Pegasus and all its members except Mr. Brown. The Company is currently in settlement discussions with Mr. Brown, but should such discussions not result in a satisfactory settlement, the Company intends to aggressively pursue all of its legal remedies against Mr. Brown. On September 15, 2014, the Company entered into a settlement agreement with Pegasus and its members except Mr. Brown, the principle terms of which include forgiveness by Pegasus of the balance of the promissory note ($100,000 amount due as of September 30, 2014), surrender of 350,000 shares of the Company’s common stock to the Company, and placement of a lockup on most of the remaining shares of the Company’s common stock owed Pegasus and the other settling parties. Neither Pegasus nor any of its members, including Mr. Brown, has any further relationship with the Company in any form.

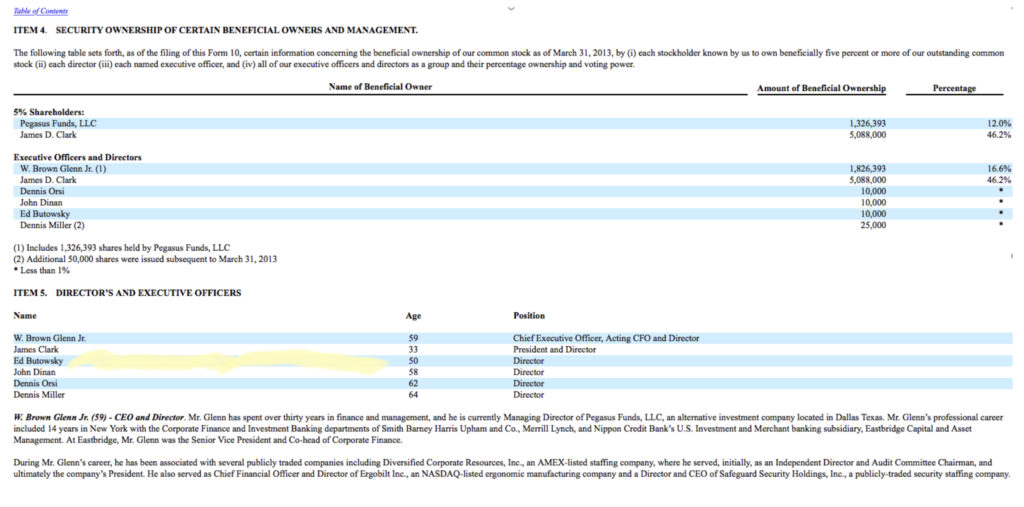

Ed Butowsky promoted CORE RESOURCE MANAGEMENT, INC. including a video (720 investor) on youtube. Butowsky never disclosed he was a board member or that he had Beneficial Ownership in the Company.

Chapwood’s Butowsky Joins Core Resource Board

Form 10-K Core Resource Management For: Dec 31,2014

On or about August 21, 2013, W. Brown Glenn, Jr., the Chief Executive Officer and a director of the Company wired $460,000 of the Company’s funds to a law firm in Minnesota to settle a judgement which had been entered against Pegasus in a matter completely unrelated to the Company. In his instructions to the Company’s bank, Mr. Brown indicated the wire was for a transaction with Nacona Production Company and caused the Company to file its Form 10-K reflecting that the wire was a deposit against a pending asset acquisition, all of which was not true. The Company has been aggressively pursuing its claims against Pegasus and its members including, Mr. Brown. The Company has settled its claims against Pegasus and all its members except Mr. Brown. The Company is currently in settlement discussions with Mr. Brown, but should such discussions not result in a satisfactory settlement, the Company intends to aggressively pursue all of its legal remedies against Mr. Brown. On September 15, 2014, the Company entered into a settlement agreement with Pegasus and its members except Mr. Brown, the principle terms of which include forgiveness by Pegasus of the balance of the promissory note ($100,000 amount due as of September 30, 2014), surrender of 350,000 shares of the Company’s common stock to the Company, and placement of a lockup on most of the remaining shares of the Company’s common stock owed Pegasus and the other settling parties. Neither Pegasus nor any of its members, including Mr. Brown, has any further relationship with the Company in any form.

3 thoughts on “720 Investor is the brainchild of Ed Butowsky and Joseph Harber”